OTTAWA — Hopes for a stronger economy faded quickly for many Canadians under Prime Minister Mark Carney’s leadership. A recent Fraser Institute study notes that the typical Canadian family now hands over 42.3% of their income to taxes, a higher share than what they spend on their home, food, and clothing combined.

Findings from the 2025 Canadian Consumer Tax Index show families are caught in a cost-of-living struggle made worse by more than ten years of Liberal rule. Inflation keeps climbing, government tax bills grow larger, and household budgets feel the squeeze. As a result, more Canadians are looking to the U.S. for relief, and some new immigrants are leaving, no longer able to manage expenses in Canada.

The latest Fraser Institute numbers, published July 22, 2025, reveal that the average family earning $109,235 paid $48,306 in taxes in 2024, about 43.1% of their income. That’s much higher than the $38,930 (35.6%) needed for essentials like housing, food, and clothing.

Since 1961, family tax bills jumped by a huge 2,784%, far more than the increases in shelter (2,129%), food (927%), or clothing (460%). The Consumer Price Index rose by 925% during the same stretch. Jake Fuss of the Fraser Institute summed it up simply: “Taxes are now the single largest expense for Canadian families. This leaves less for households already juggling higher prices.”

Families now face tax bills from many fronts: federal and provincial income taxes, sales taxes, property taxes, and carbon taxes. Tax Freedom Day in 2025 arrived on June 8, so the average family worked nearly six months just to cover various taxes.

A Decade of Liberal Promises and Troubling Results

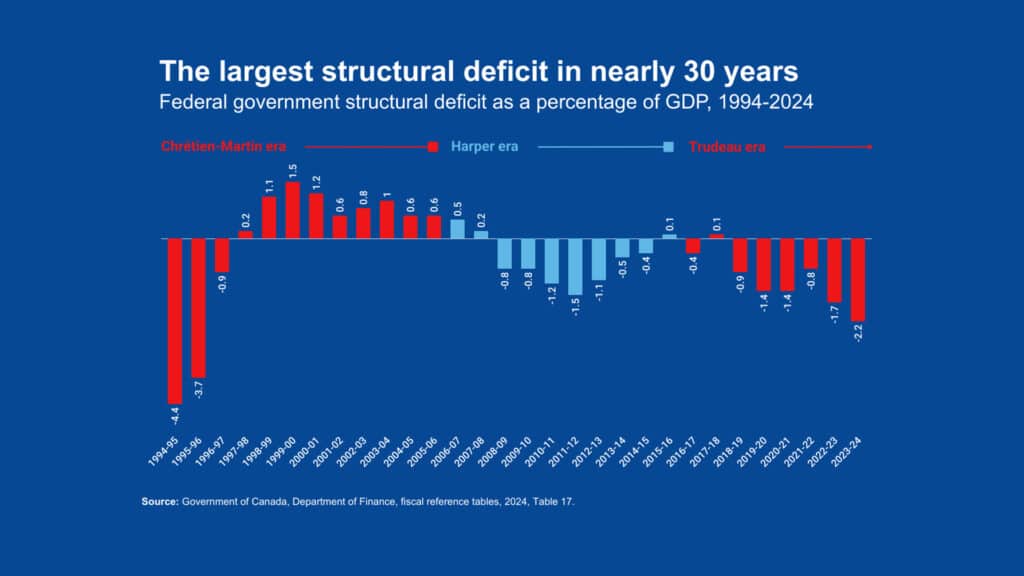

Justin Trudeau’s Liberals came into office in 2015 vowing to support the middle class and ease financial pressure. Critics say the focus on expanded social programs, new climate policies, and bigger public service payrolls has produced high deficits and growing debt, but little actual relief.

From 2015 to 2024, federal program spending soared as the government hired over 110,000 new public servants — a 43.1% rise. Deficits kept climbing, estimated at $70 billion in 2025-26, up from $42.2 billion when Trudeau led, and on pace to reach $62.3 billion in Carney’s first year.

Carney, once governor of the Bank of Canada, entered the Liberal leadership in 2025 with promises of middle-class tax breaks, economic renewal, and a change of course from Trudeau.

He pledged to cut the lowest personal income tax rate from 15% to 14%, starting July 1, 2025, saving dual-income families as much as $840 a year. But analysts, including those at the Fraser Institute, see little impact from this move. Jake Fuss explained: “This tax cut is so limited that it doesn’t boost incentives or help Canada compete for top talent.”

At the same time, the reduction comes hand-in-hand with higher federal spending. The Liberal party plans to spend another $29.4 billion this year, increasing the deficit and the size of interest payments on the national debt.

“This isn’t true tax relief; it’s just pushing the problem into the future with more borrowing,” warned Jason Clemens from the Fraser Institute. “Interest payments take away funds from health care, real tax relief, or other services.”

Rising Taxes and Slow Growth Add to Frustration

More than a decade of Liberal leadership has left lasting economic side effects. Inflation spiked to an 18-year high in 2021. Even now, families pay much more for groceries, housing, and fuel.

The standard of living, measured as real GDP per person, slipped from $59,905 in June 2019 to $58,601 in September 2024, with only a small uptick (0.4%) in early 2025. The Fraser Institute points out that from 2014 to 2022, Canada’s per-person economic growth lagged near the bottom compared to most advanced countries.

Carney’s climate strategy also faces harsh reviews. He ended the direct consumer carbon tax right away, but his plan to raise carbon taxes on industrial polluters is expected to drive up costs for most consumer goods and services, indirectly affecting households. Kenneth P. Green at the Fraser Institute commented, “People will feel the pinch with higher prices, even if it doesn’t show up as a direct tax.”

Canadians Relocating, Newcomers Leaving

The heavy tax load and unaffordable living costs are pushing many Canadians to move to the U.S., where taxes and daily expenses are often lower. Across Canada, combined federal and provincial income tax rates are higher than almost all U.S. states for those making $50,000, $150,000, or $300,000.

This gap, along with flat economic growth, makes the United States more appealing for skilled workers, business owners, and families.

Another worrying trend is the increasing number of immigrants considering leaving Canada. Reuters reported in 2023 that emigration reached a 20-year peak in 2019 and has been rising since the pandemic.

Newcomers are returning home, frustrated by high rent and overstretched public services. Justinas Stankus, a doctoral student from Lithuania in Toronto, told Reuters he is thinking about moving to Southeast Asia, where the cost of living is lower.

Cara, a refugee from Hong Kong, said she spends 30% of her pay on a basement apartment and feels trapped. The Liberal plan to welcome 500,000 permanent residents in 2025 has only made the housing crunch worse as building hasn’t kept up with demand, pushing prices even higher.

Disappointment with Carney’s Economic Promises

Many hoped Carney’s entry into politics would trigger a turnaround. Instead, many voters see a repeat of earlier policies: high taxes, big deficits, and no sense of relief. “We wanted change, but we’re getting a repeat of high taxes and mounting debt,” said Sarah Thompson, a small-business owner in Vancouver. Social media users echo these feelings, criticizing Carney’s plans to ramp up government spending further.

The Liberal platform’s proposal for $130 billion in new programs over four years, including more tax cuts and housing support, has drawn sharp criticism. Conservative Leader Pierre Poilievre calls it a spending spree, and the Fraser Institute warns it could send total debt to $225 billion in only four years. Higher government debt could dry up private investment and keep growth slow.

Rising costs, declining living standards, and departures of skilled workers and newcomers put fresh demands on Carney’s government. The Fraser Institute suggests meaningful tax cuts, less government spending, and strategies to make Canada more competitive and attractive for investors. “The government needs to spend less, balance the budget, and fix taxes if Canada is to recover,” said Fuss.

For people like Stankus and Thompson, hope has given way to worry. With families now paying more in taxes than on food, housing, and clothing, and as more Canadians and immigrants leave in search of a better life, only bold action from the government can stop the slide. Many Canadians are waiting to see if real solutions arrive soon.