OTTAWA – Mark Carney took office as Canada’s Prime Minister in March 2025, stepping into a tough environment. President Donald Trump’s return brought harsh tariffs against Canadian electric vehicles, steel, and aluminum, pushing Canada into a tough trade war.

While Carney spoke about building closer ties with partners in Europe, many saw his focus shift toward deeper engagement with China, Canada’s second-largest trade partner. This move has sparked strong debate, given the lingering tension from past disputes with Beijing, including the 2018 detention of two Canadians.

Carney’s background includes leading roles at the Bank of Canada, Bank of England, and, most recently, as chairman of Brookfield Asset Management. His resume is impressive, but his financial history has raised eyebrows.

During his time at Brookfield, the investment giant directed over $3 billion into Chinese real estate, green energy projects, and other interests, often alongside state-backed firms. Brookfield also took out a $276 million loan from the state-owned Bank of China in 2024, just before Carney left to enter politics.

Public concern centres around whether these financial links could affect Carney’s decisions now that he leads Canada.

Carney’s Vested Interests in China

Critics argue that he may have a vested interest in maintaining good relations with Beijing, especially given the size of Brookfield’s investments and his own reported stock holdings, which were valued at $6.8 million in options and millions more in shares at the end of 2023.

Although Carney says these assets are now in a blind trust, government ethics experts point out that blind trusts don’t eliminate the risk of bias.

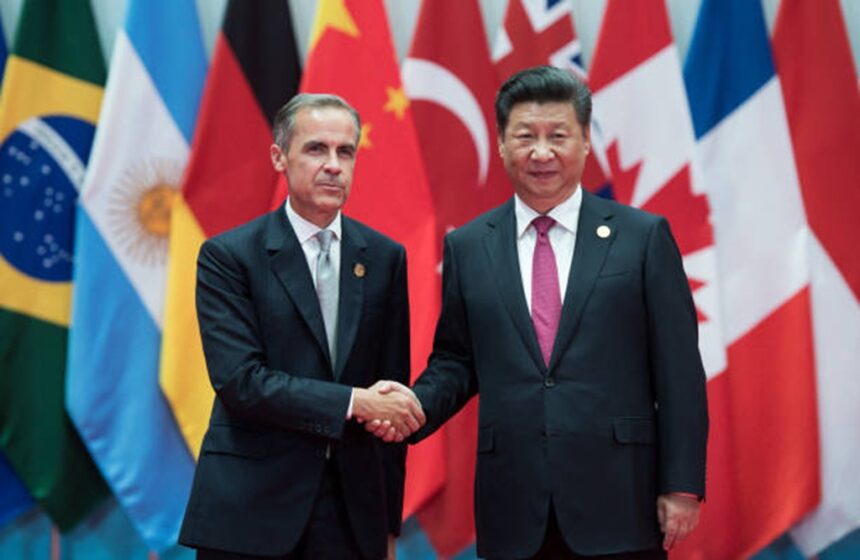

The risks of appearing too close to China are high. On June 5, 2025, Carney met with Chinese Premier Li Qiang to discuss trade and investment. China, according to official statements, views the partnership as a chance to grow, not a threat.

Markets responded well, hoping for relief from Chinese tariffs that have hurt Canadian farmers and fishers. But Carney’s position is not clear-cut. Just weeks before, he called China Canada’s “biggest security threat” due to concerns around foreign interference.

This mixed messaging has given Conservative Leader Pierre Poilievre and other critics lots of material. Poilievre has accused Carney of favouring Beijing because of his past at Brookfield.

The criticism is echoed by a large segment of the public. Recent studies show that about 70% of Canadians hold unfavourable views of China, and many worry about foreign involvement in Canadian politics.

Carney Brookfield Ties

Brookfield’s business in China is extensive. The company’s largest deal was a $2 billion purchase of an office tower complex in Shanghai in 2019. This, along with investments in renewable projects, often involved partnerships with firms linked to the Chinese Communist Party.

The $276 million refinancing deal from the Bank of China stands out, especially since it happened just after Carney reportedly met with senior officials at the People’s Bank of China. While these meetings were published, the timing has led to widespread speculation, especially on social media, where users have questioned what was exchanged for this financial support.

During his time at Brookfield, Carney publicly complimented Xi Jinping’s leadership and supported China’s ambitions for its currency to play a bigger global role. For some, this is proof that Carney’s economic interests could influence his political decisions, particularly when dealing with China.

Carney’s financial setup has added to the conflict-of-interest concerns. Though he claims to have put his Brookfield shares into a blind trust, ethics specialists like Ian Stedman at York University say these arrangements aren’t always effective.

A prime minister could still make decisions that would affect the value of those assets, even if only subconsciously. Carney has tried to address the criticism by setting up rules to recuse himself from government decisions linked to Brookfield or Stripe, another firm where he was a board member. However, opposition politicians are not satisfied.

Demands for Full Transparency

Poilievre has demanded full transparency and challenged Canadians to question if their leader can act independently when his former company still owes huge sums to China’s state bank. The NDP says Carney’s ties show he puts big business ahead of everyday Canadians, pointing to criticism of Brookfield’s aggressive real estate practices.

Liberal Party supporters say these attacks are based on conspiracy theories and insist Carney’s record as a top central banker gives him the skills to protect Canada’s interests. Still, the optics of a prime minister with substantial holdings in a firm so deeply linked to China are hard to ignore.

Carney also pushed green investments at Brookfield, helping to form partnerships with Chinese institutions like the Asian Infrastructure Investment Bank. He has promoted carbon trading and other climate projects, which some see as smart moves for Canada’s economy.

Others worry these deals could lock Canada tightly into Beijing’s sphere at a time when relations with both the US and China are under strain.

The broader context remains tense. China’s ambassador to Canada has said he hopes for better relations, but Carney’s comments about China being a security threat show he is trying to keep a careful balance.

US Protectionism

Some analysts and political activists believe Canada has missed the opportunity to work more closely with China and reduce the risk of conflict, but public trust in such engagement remains low, especially amid stories of foreign influence during elections.

Carney is under enormous pressure to shield Canada from US protectionism while making sure the country does not become too dependent on China. His connections to Brookfield, his stock holdings, and his past work with Chinese officials continue to hang over his leadership.

Even with measures like blind trusts, many Canadians have doubts. Poilievre’s attacks paint Carney as compromised, playing into frustration with ongoing Liberal scandals and concerns over foreign meddling.

Social media reflects this divide, highlighting Carney’s tough position: accused of calling China a threat in public while his firm cut billion-dollar deals there in private. Whether fair or not, this debate is not going away soon.

The challenge for Carney is to convince Canadians that he is working for their benefit, not for the interests of former business partners or his bottom line. If he fails, both his reputation and Canada’s independence in global trade could be at stake.